net investment income tax 2021 form

It states on page 11. Future Developments For the latest information about.

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Computed in 2021 Manufacturing investment credit Research expense credit.

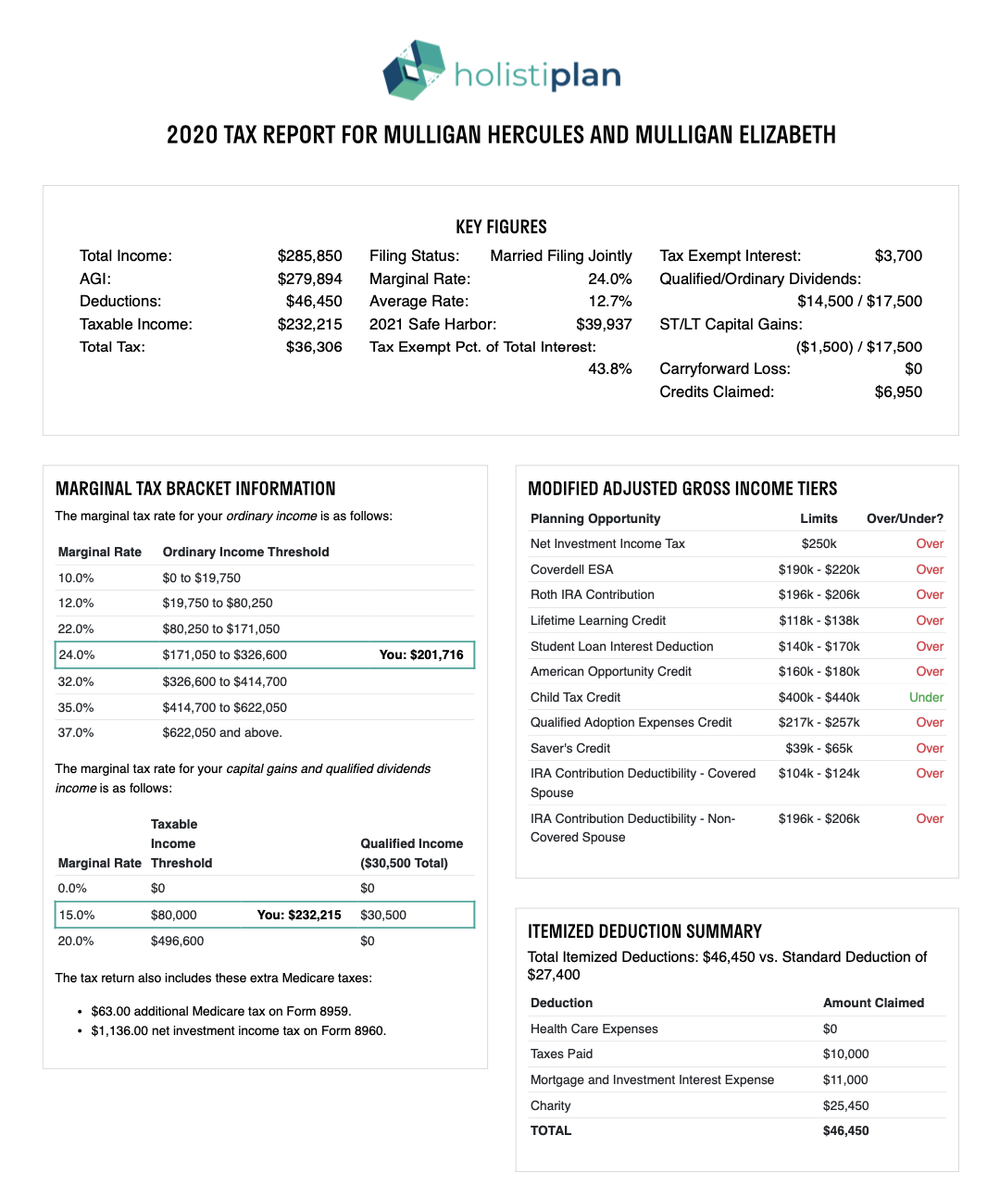

. The tax explained. Married filing jointly or qualifying widower 250000. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

Single or head of household 200000. You are charged 38 of the lesser of net investment income or the amount by. Special rules apply for certain unique types of trusts such a Charitable Remainder Trusts and Electing Small Business Trusts.

2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Find Forms for Your Industry in Minutes. In 2021 this threshold amount is 13050.

Some trusts including Grantor Trusts and Real Estate Investment Trusts REIT are not subject to. The total of your Net Investment Income is less than 50000 so the total Net Investment Income is subject to the. The individual is entitled to reduce his net.

Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. Free means free and IRS e-file is included. Streamlined Document Workflows for Any Industry.

NIIT is a 38 tax on the lesser of net investment income or the excess of the childs modified adjusted gross income MAGI over the threshold amount. Tax or reduced items of passive investment income by an amount of federal. More specifically this applies to the lesser of your net investment income or the amount by which.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960 fully updated for tax year 2021. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income.

Ad IRS Tax Forms Catalog more Fillable Forms Register and Subscribe Now. Generally net investment income includes gross income from interest dividends annuities and royalties. If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT. Max refund is guaranteed and 100 accurate. Subtract the MFJ threshold of 250000 from your MAGI of 300000 resulting in 50000.

The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. More about the Federal Form 8960 Other TY 2021. All of your 20000 Net Investment Income is subject to the NIIT.

The threshold amounts are based on your filing status. For purposes of the NIIT. See how much NIIT you owe by completing Form 8960.

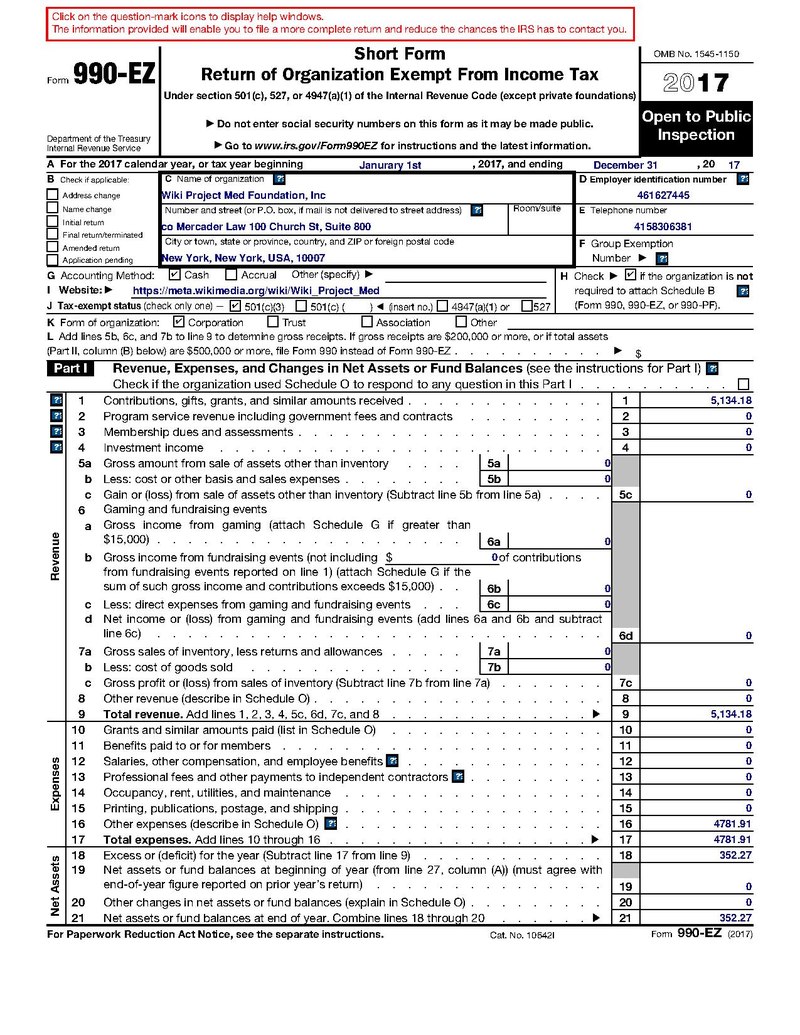

The estates or trusts portion of net investment income tax is calculated on Form 8960 Net Investment Income TaxIndividuals Estates and Trusts and is reported on Form 1041. 1 It applies to individuals families estates and trusts but certain income thresholds must be met before the tax takes effect. Include state local and foreign income taxes you paid for the tax year that are attributable to net investment income You can determine the portion of your state local and foreign income taxes allocable to net investment income using any.

Taxpayers use this form to figure the amount of their net investment income tax NIIT. This tax is also known as the net investment income tax NIIT. The IRS gives you a pass.

Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. Guaranteed maximum tax refund. April 8 2021 756 AM.

Married filing separately 125000. You can download or print current or past-year PDFs of Form. UseForm 8960 Net Investment Income Tax to figure this tax.

Additions for state taxes. Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers income for regular income tax to 490000. All About the Net Investment Income Tax.

If you are required to file Form 8918 for federal income tax purposes and the reportable. April 28 2021 The 38 Net Investment Income Tax. Net investment income can.

Ad Free tax filing for simple and complex returns. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified adjusted gross income exceeds the taxs thresholds. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

Ad State-specific Legal Forms Form Packages for Investing Services. A recovery or refund of a previously deducted item increases net investment income in the year of the recovery It does not state whether it is the recovery of the state income tax refund or the federal income tax refund.

How To Read Your 1099 Robinhood

Net Investment Income Tax Niit Quick Guides Asena Advisors

Tax Calculator Estimate Your Income Tax For 2022 Free

Capital Gains Depreciation Recapture 1031 Exchange Rules 2021 Update

How To Calculate The Net Investment Income Properly

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Tax Planning Fiduciary Fee Only Financial Advisor In Milwaukee Chicago Minneapolis

What You Need To Know About Capital Gains Tax

2021 Schedule Eic Form And Instructions Form 1040

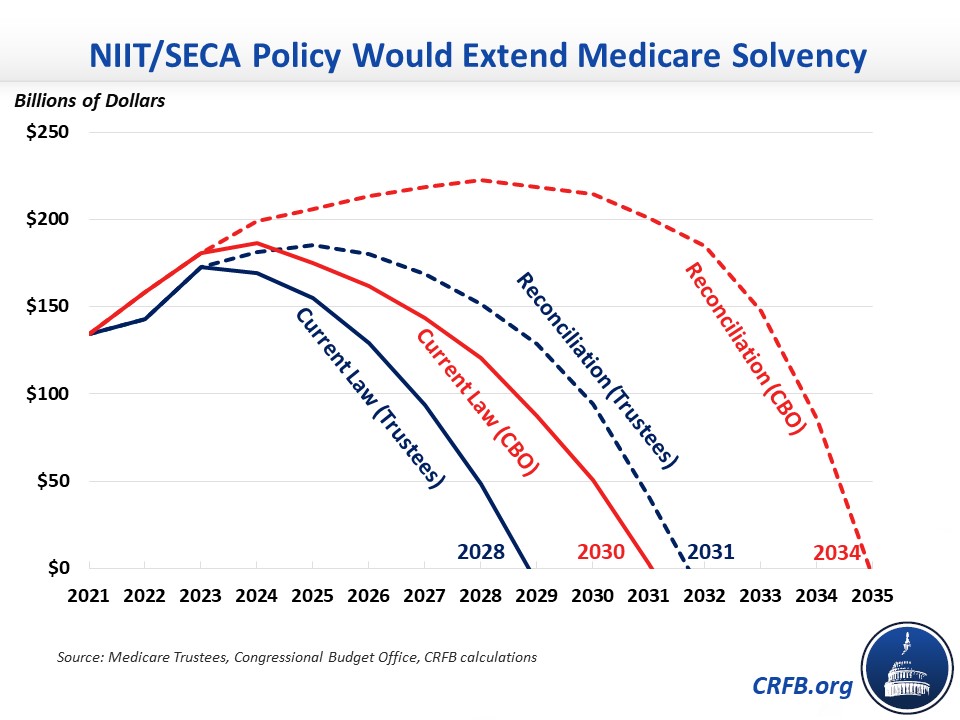

Reconciliation Could Improve Medicare Solvency Committee For A Responsible Federal Budget

Business Tax Quick Guide Tax Year 2021

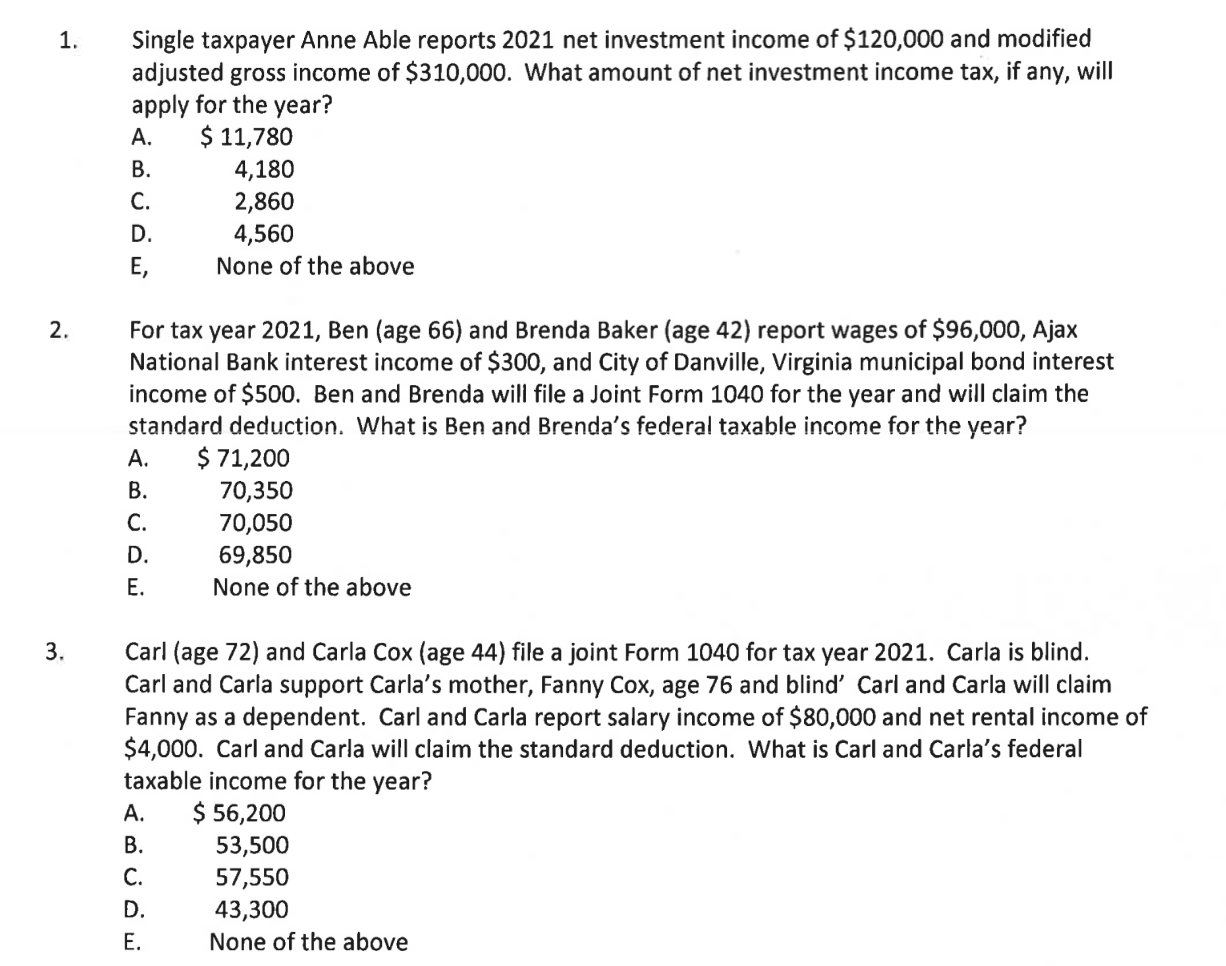

Solved 1 Single Taxpayer Anne Able Reports 2021 Net Chegg Com

Solved You Are Working As An Accountant At A Mid Size Cpa Firm One Of Your Clients Is Bob Jones Bob S Personal Information Is As Follows October Course Hero

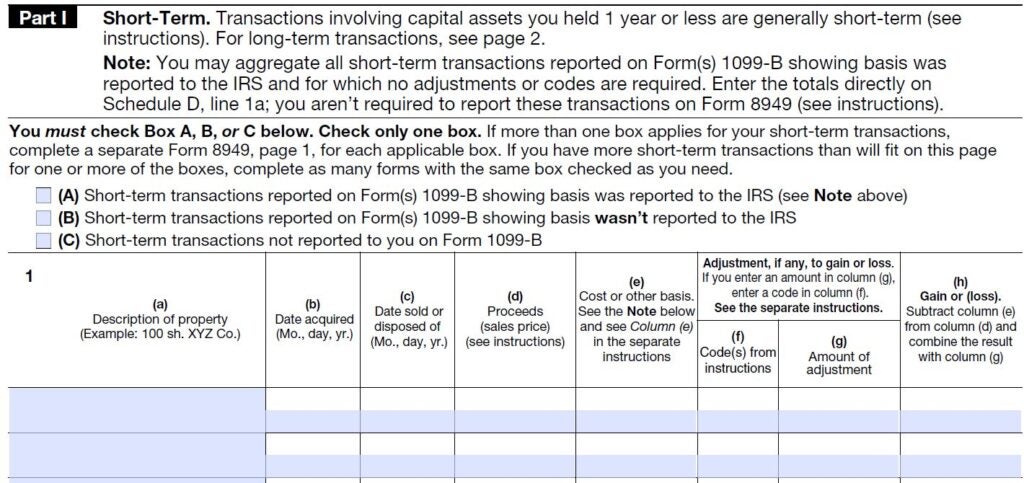

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

How Are Capital Gains Taxed Tax Policy Center

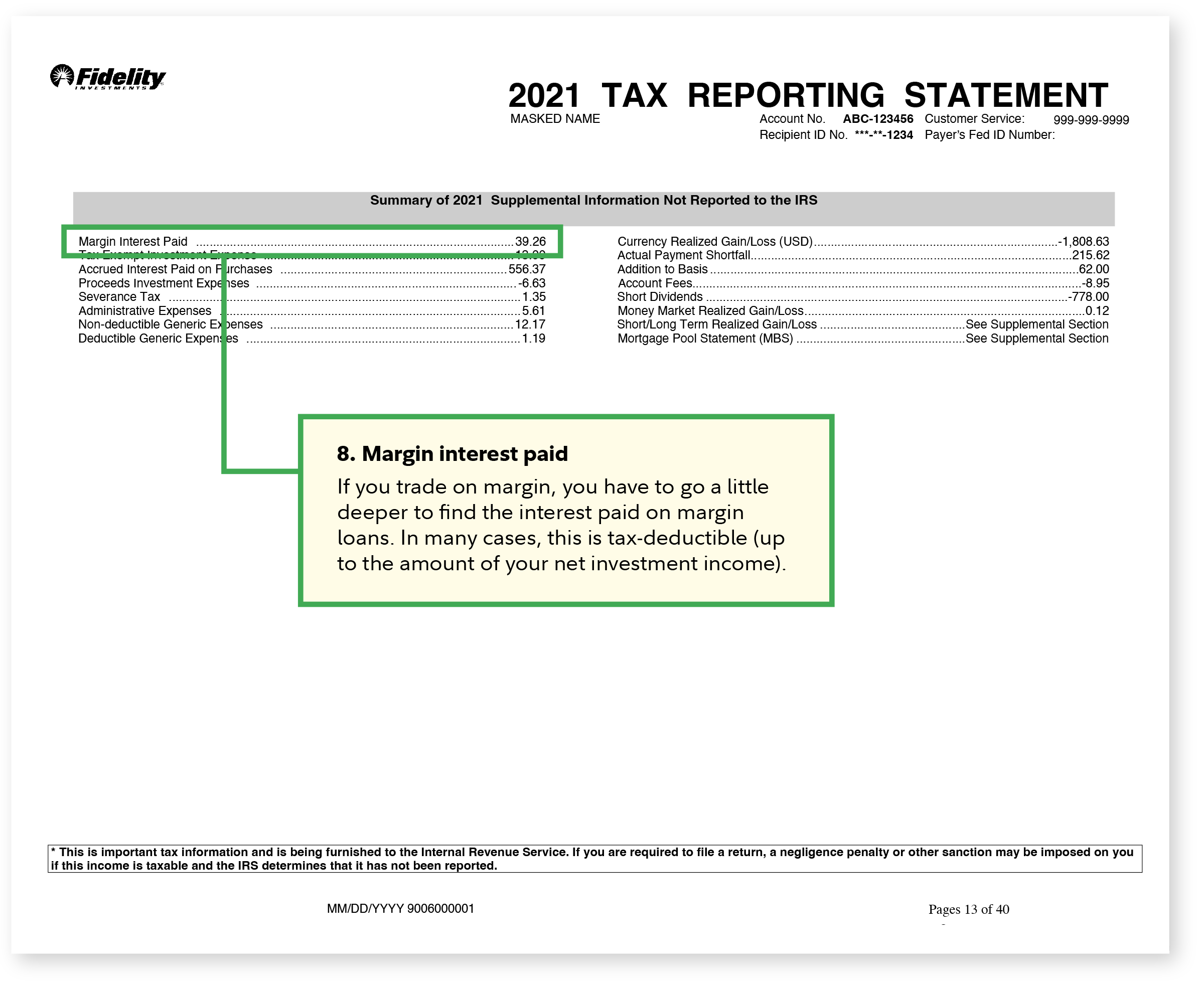

Got Questions On Your 1099 Tax Reporting Form We Created A Simple How To Read Tax Form Guide That Covers What You Need To Know In Order To Understand What All Those

How To Complete Form 1120s Schedule K 1 With Sample

How To Complete Irs Form 8960 Net Investment Income Tax Of 3 8 Youtube