rhode island state tax rate 2020

Exact tax amount may vary for different items. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

State Income Tax Rates And Brackets 2021 Tax Foundation

The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax.

. 34 cents per gallon of regular gasoline and diesel. Rhode Island new employer rate. Detailed Rhode Island state income tax rates and brackets are available on this page.

RI or Rhode Island Income Tax Brackets by Tax Year. Find your pretax deductions including 401K flexible account. The state of Kansas has a flat Corporate income tax rate of 700.

The exemptions and deductions are. 2020 Tax Rates. Low Tax States Are Often High Tax For The Poor Itep.

The Rhode Island Division of Taxation has released the state income tax. Additional State Income Tax Information for Rhode Island. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator.

Income Tax Brackets for Other States. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375.

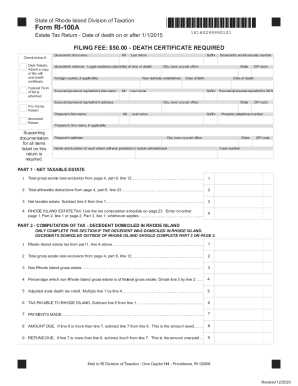

The Rhode Island State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 Rhode Island State Tax CalculatorWe also. If you live in Rhode Island and are thinking about estate planning this. Start filing your tax return now.

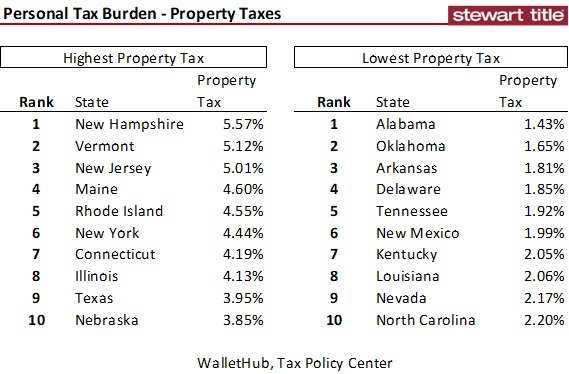

The top rate for the Rhode Island estate tax is 16. The average effective property tax rate in Rhode Island is the 10th-highest in the country though. Start filing your tax return now.

The phase-out range for the personal exemption and deduction is 203850 - 227050. The tax rates range from between 375 to 599 for 2020. The highest bracket starts at 148350.

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. About Toggle child menu. TAX DAY IS APRIL.

Like most other states in the Northeast Rhode Island has. It kicks in for estates worth more than 1648611. 1300 per thousand of the assessed property value.

Rhode Islands 2022 income tax ranges from 375 to 599. Find your income exemptions. TAX DAY IS APRIL.

A list of Income Tax Brackets and Rates By Which You Income is Calculated. The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also. 3 rows The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of.

Detailed Rhode Island state income tax rates and brackets are available on this page. Above rates do not include Job Development Assessment of 21 or 008 adjustment for 2020. State of Rhode Island Division of Municipal Finance Department of Revenue.

153 average effective rate. 2022 Rhode Island state sales tax. Rhode Island Income Tax Rate 2022 - 2023.

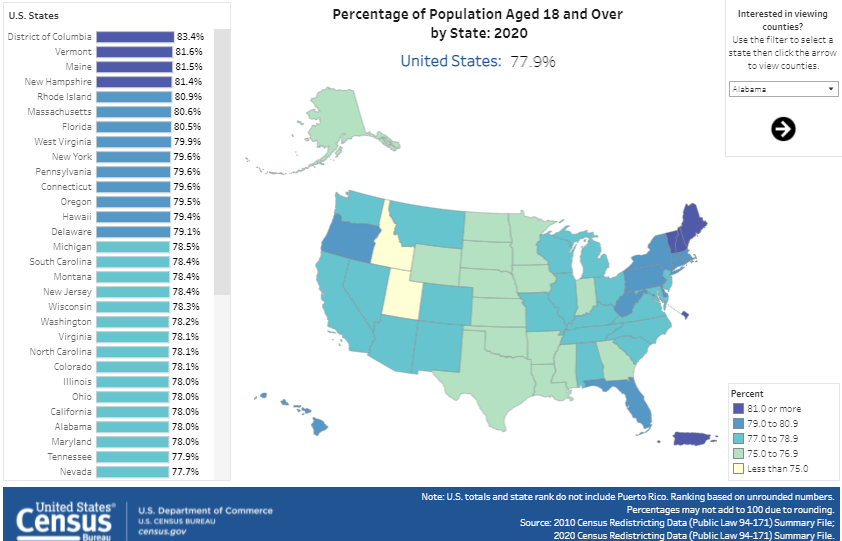

R I Latino Population Grew By Nearly 40 Percent In The Past Decade Census Shows The Boston Globe

U S Top 5 Earners For Sports Betting Tax Revenue By State In 2020 Gaming And Media

Riddc It S Tax Time Tax Credit Information And Also Free Tax Preparation Service Is Available To See A List Of The 2021 Vita Sites In Rhode Island Click This Link Http Www Economicprogressri Org Index Php Volunteer Income Tax Assistance Vita

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

How Do State And Local Sales Taxes Work Tax Policy Center

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent

Moving To A No Income Tax State Is An Expensive Way To Save Money Bloomberg

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

What Are Estate And Gift Taxes And How Do They Work

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island State Economic Profile Rich States Poor States

Get And Sign Rhode Island Form 1041 Schedule W Fiduciary Schedule W 2020 2022

Please Get To The Polls On October 22 2020 For The All Day Budget Referendum Coventry

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island 30 Towns To Decide On Marijuana Sales Measures This November Norml

Rhode Island S Happy And Sad Tax Form Signals Don T Mess With Taxes